Iowa State Income Tax 2025. As part of its comprehensive tax reform, effective january 1, 2025, iowa consolidated its four individual income tax brackets into three ( h.f. (the center square) — iowans will keep more of their money in their pockets in 2025.

Intended for those who would benefit from a more comprehensive set of instructions. Other proposals included a bill to gradually eliminate iowa’s individual income tax, with a drop to 3.775% in 2026.

Another Banner Year for State Tax Cuts Will Iowa Continue to Lead in, Income tax tables and other tax information is sourced from the iowa department of. Only 10 states do or will continue to tax social security benefits in 2025.

Iowa Tax Changes Effective January 1, 2025 ITR Foundation, Your average tax rate is 10.94%. Iowa has a progressive tax system that features a top marginal income tax rate of 6%.

Iowa Tax Calculator 2025 2025, Other proposals included a bill to gradually eliminate iowa’s individual income tax, with a drop to 3.775% in 2026. If you make $70,000 a year living in iowa you will be taxed $11,465.

Iowa Tax Brackets 2025, Iowa annual salary after tax calculator 2025. Support for eliminating the income tax has grown since the last time the iowa poll tested the issue, in march 2025.

2025 Iowa Tax Brackets New 2026 Iowa Flat Tax, 0 Retirement Tax, (the center square) — iowans will keep more of their money in their pockets in 2025. “they are colorado, connecticut, kansas, minnesota, montana, new mexico, rhode island, utah, vermont.

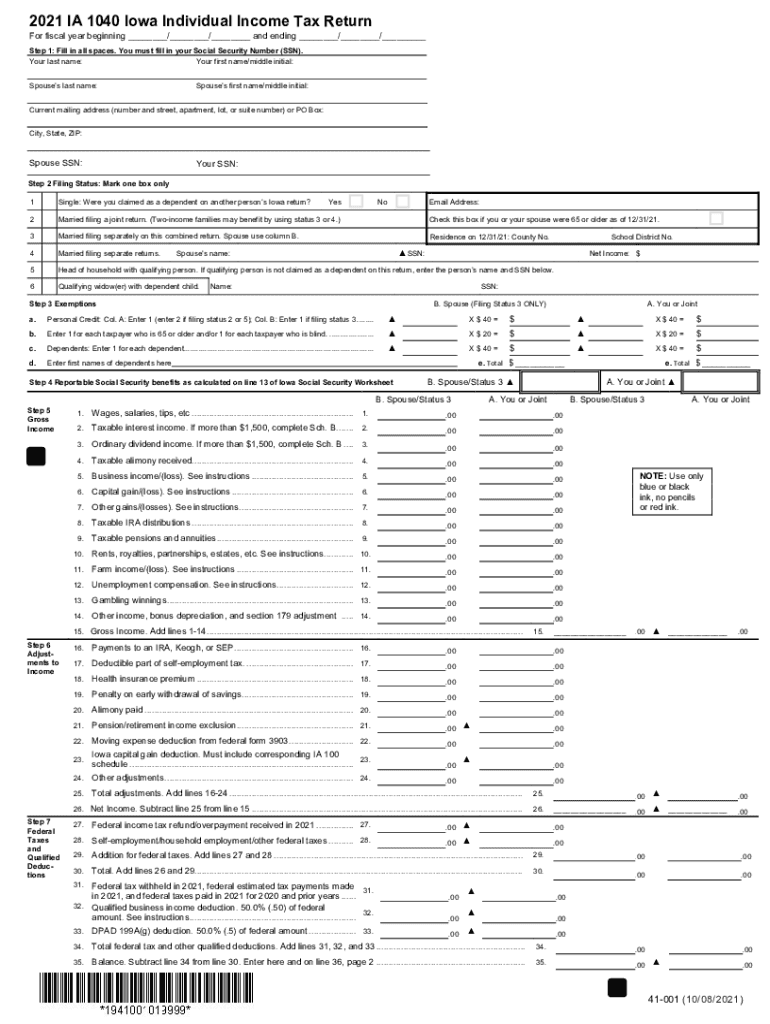

Iowa state tax Fill out & sign online DocHub, The annual salary calculator is updated with the latest income tax rates in iowa for 2025 and is a great calculator for working out your. That poll found 56% of iowans favored eliminating.

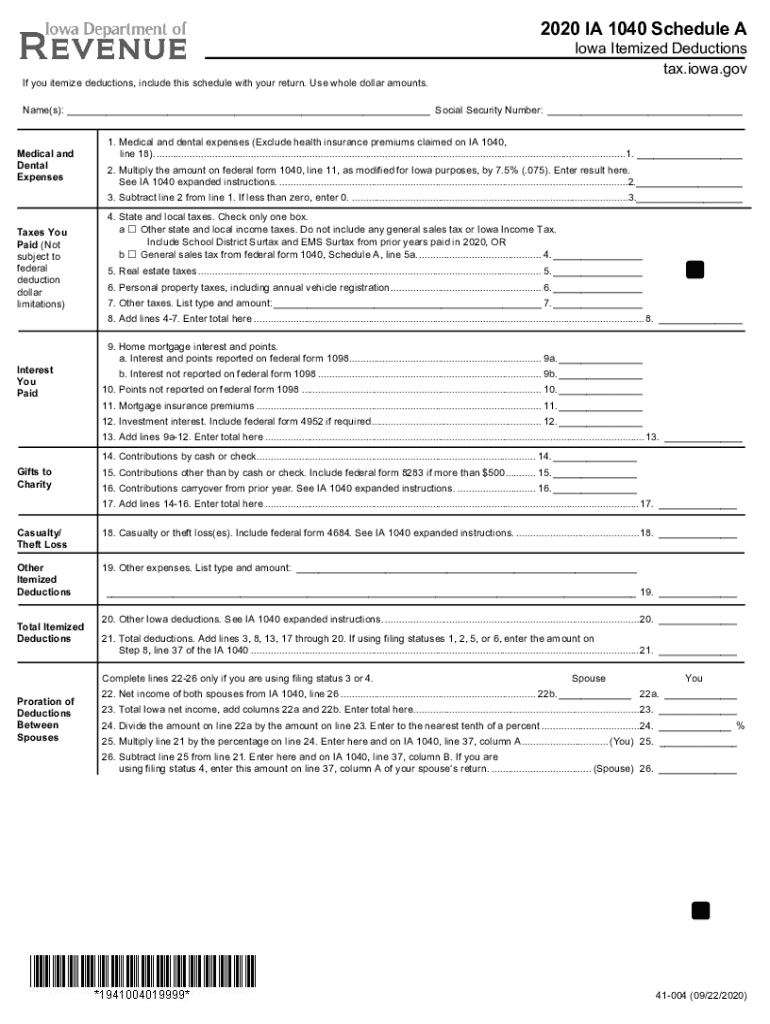

Ia 1040 form Fill out & sign online DocHub, Your average tax rate is 10.94%. The hawkeye state has sales taxes near the national average, while the typical property tax rate is above the national average.

Iowa w4 Fill out & sign online DocHub, “they are colorado, connecticut, kansas, minnesota, montana, new mexico, rhode island, utah, vermont. The hawkeye state has sales taxes near the national average, while the typical property tax rate is above the national average.

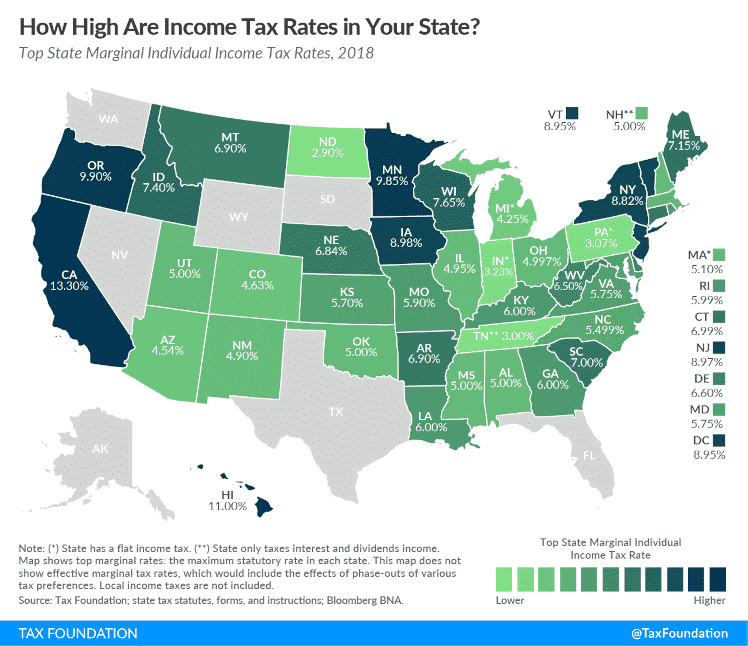

State Individual Tax Rates and Brackets Tax Foundation, Only 10 states do or will continue to tax social security benefits in 2025. States that don't have any income tax.

02 Iowa 2025 tax bracket Arnold Mote Wealth Management, Other proposals included a bill to gradually eliminate iowa’s individual income tax, with a drop to 3.775% in 2026. 30.7 cents per gallon for gasoline and 32.5 cents per gallon.